The IRS began accepting and processing individual federal tax returns for the 2026 tax season on January 26.

Here are a few important points to keep in mind:

- Most individual returns are due by April 15 to avoid penalties and interest.

- Filing early may help reduce delays related to processing or identity verification.

- Refund amounts can vary based on withholding and recent tax law changes.

As tax season gets underway, reminders like these can help you avoid last-minute filing challenges.

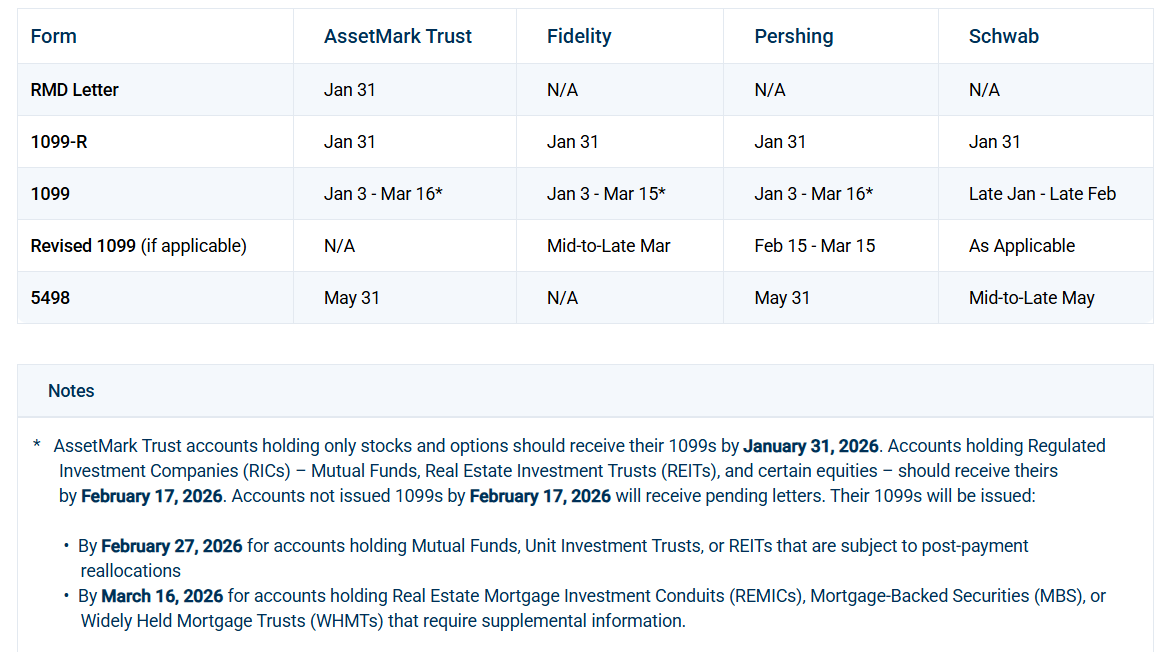

Below is a schedule outlining when companies expect documents to be ready.

If you are looking for individual tax documents, visit the tax document section of our website.

If you are looking for help with your taxes, DSFG Tax & Advisory is here to help! To learn more about their services, fill out the interest form.

***

Cetera Wealth Services, LLC exclusively provides investment products and services through its representatives. Although Cetera does not provide tax or legal advice, or supervise tax, accounting or legal services, Cetera representatives may offer these services through their independent outside business. This information is not intended as tax or legal advice.