1. Focus on What You Can Control

Market movements, business decisions, economic events, politics, interest rates—many factors can influence the performance of your investments. Instead of worrying about events that are out of your hands, focus on what’s in your control.

Build an investment strategy that reflects your goals, time horizon and risk tolerance.

Diversify. But remember diversification is an approach to help manage investment risk. It does not eliminate the risk of loss if security prices decline.

Manage your tax situation.

2. Put Time on Your Side

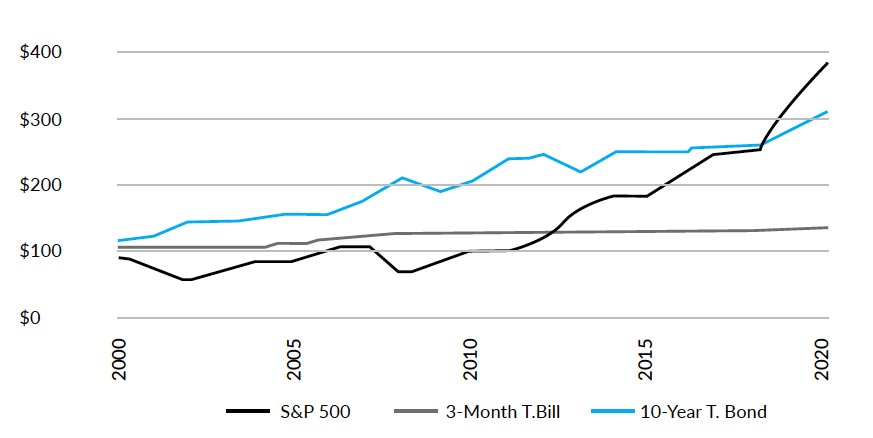

The financial markets have rewarded long-term investors. The chart shows how various asset classes have performed over time. Keep in mind, however, that past performance does not guarantee future results and individuals can’t invest directly in an index.

Hypothetical Growth of $100, 2000–2020 (Compounded Annually) ¹,²

The S&P 500 posted losses in 2000, 2001, and 2002, while the 10-year bond notched gains.

3. Tune Out the Noise

News cycles driven by fear, uncertainty, and doubt can challenge even the most disciplined investor. Some headlines spark anxiety, while others try to goad you into chasing the hottest fads and trends. Although we live in an era of seemingly infinite data, information overload can cause you to reconsider investment decisions.

4. Don’t Try to Time Markets

Market timing is the strategy of trying to predict future market movements to time buying and selling decisions. When markets are rallying or pulling back, it can be very tempting to try to seek out the top to sell or the bottom to buy. The problem is that investors usually guess wrong, missing out on the best market days. Another approach is to focus on time in the markets, which may let you ride out the natural market cycles and focus on your long-term goals.

3 WAYS TO MANAGE MONEY

Determine Your Time Horizon

Understanding your time horizon is a critical first step in determining what type of investments may fit your overall strategy.

Be Patient, Not Reactive

It’s natural for markets to fluctuate. During periods of volatility, focus on managing your emotions rather than making changes to your portfolio.

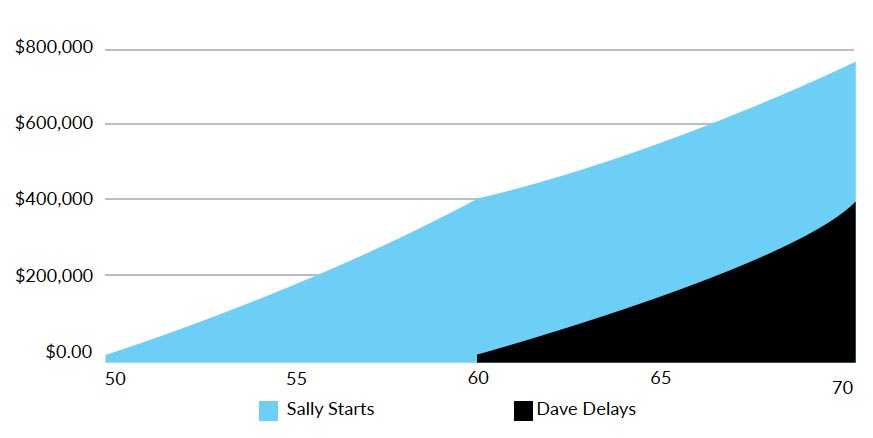

Start Early

The earlier you start, the greater the compounding potential. If you start saving and investing early, you may gain an advantage over someone who waits to save and invest.

5. Understand All Forms of Risk

Market risk– or the risk of your portfolio losing value due to factors such changing market conditions– isn’t the only type of risk to be concerned about. Personal risk, such as longer lifespans and rising healthcare costs, means that Americans needs to consider a variety of factors as they prepare for retirement. Understanding risk as it relates to your time horizon and investing goals is critical to a financial strategy.

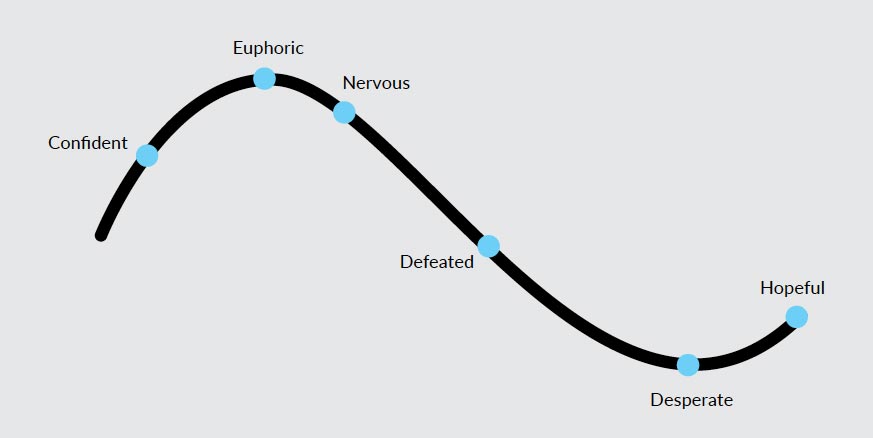

6. Avoid the Emotional Roller Coaster

Emotional decision making can lead to making the wrong decision at the wrong time. A Dalbar study found that while the S&P 500 returned 9.85% for the 20-year period ending in 2015, the average investor fared worse, seeing a return of only 5.19% during the same period. Emotional decision making was one of the factors that contributed to the difference in performance.³

7. The Cost of Procrastination

The sooner you begin investing, the longer your money can work for you. Let’s look at two hypothetical investors, Sally Starts and Dave Delays. When Sally turns 50, she starts contributing $25,000 a year to an account that earns a hypothetical 6%. After 10 years, she stops making payments. Dave puts off his investing program. At age 60, he begins setting aside $25,000 a year into an account that earns a hypothetical 6%. Though both have contributed equal amounts, Sally has the magic of compound interest working for her. When they both reach age 70, Sally’s account balance is nearly twice the size of Dave’s.4

By starting ten years earlier, Sally is able to accumulate $313,767.66 more than Dave.

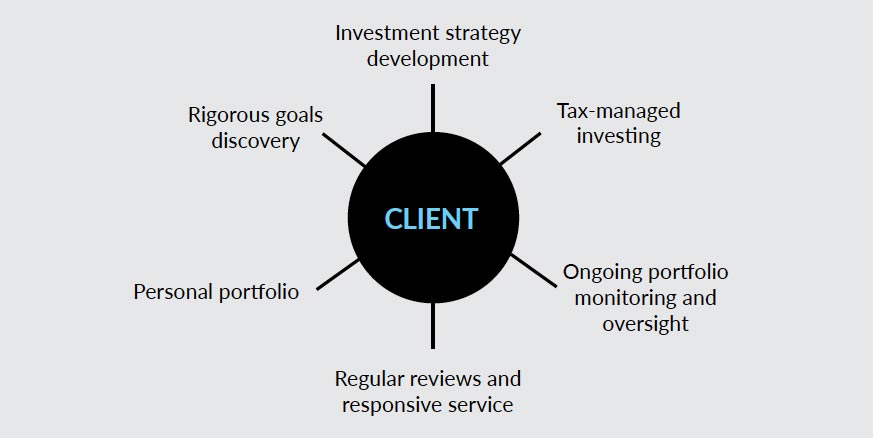

8. Delegate the Details

Financial professionals may help you create a customized portfolio strategy that’s built around your unique goals. Though we can’t control markets, we can help you use them to pursue your long-term financial goals.

Disclosures & Sources

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Past performance does not guarantee future results.

Consult your financial professional before making any investment decision.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial professional for further information.

These are the views of FMG Suite, LLC, and not necessarily those of the named representative, broker/dealer, or investment advisor and should not be construed as investment advice. Neither the named representative nor the named broker/dealer nor the investment advisor gives tax or legal advice. By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through these links. They are provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site. Securities and Investment Advisory Services offered through Securian Financial Services, Inc., Member FINRA/SIPC. Diamond State Financial Group is independently owned and operated. Neither Securian Financial Services, Inc. nor Diamond State Financial Group are affiliated with Platinum Advisor Marketing Strategies, LLC or FMG Suite. DOFU 06.2022 4768326

These are the views of FMG Suite, LLC, and not necessarily those of the named representative, broker/dealer or investment advisor, and should not be construed as investment advice. Neither the named representative nor the named broker/dealer or investment advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial professional for further information.

1. Stern.NYU.edu, 2021

2. S&P 500 return includes price appreciation and reinvestment of dividends. Treasury bond return includes coupon and price appreciation. Treasury bill return is a three-month rate. Past performance is no guarantee of future results. Indexes are not available for direct investment. Historical performance does not reflect taxes and fees associated with the management of an actual portfolio.

3. The Balance.com, 2020

4. This example is for illustrative purposes only and does not represent an actual investment or combination of investments. Annual contributions are made at the beginning of the compounding period. This hypothetical example does not reflect taxes or any fees. Past performance does not guarantee future returns.

Diamond State Financial Group has a team of dedicated financial advisors to help you with each of these timeless principles of investing. Schedule a free consultation!

This post answers common questions like:

How can I manage investment risks effectively?

What are some techniques to avoid making emotional investment decisions?

What are the best long-term investment strategies?