Medical Professionals Division

Specializing in services for medical professionals, we offer customized strategies to compliment every stage of your career. Our financial professionals will help you build wealth and prepare for the future without sacrificing your valuable time.

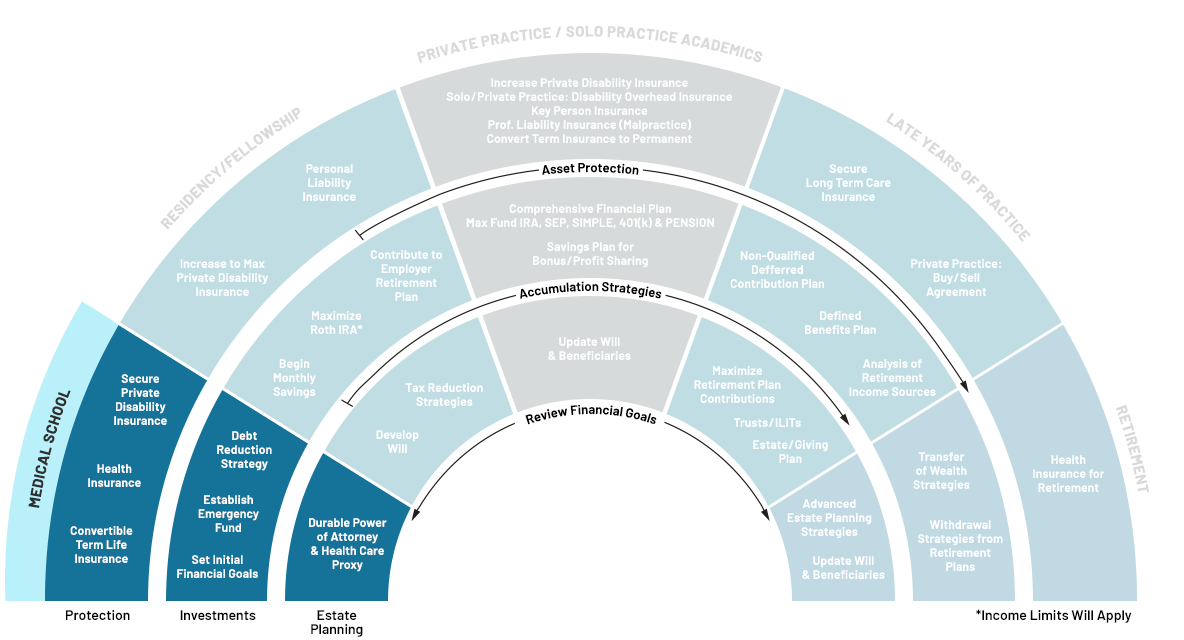

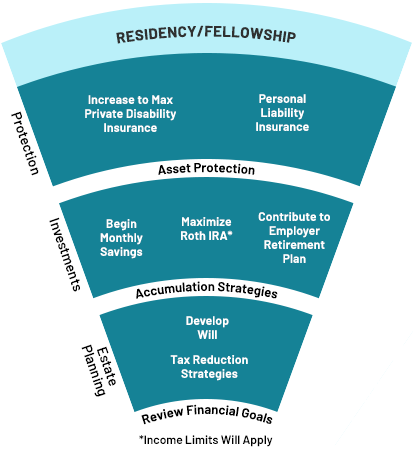

Residency/

Fellowship

You are facing some of the first significant transitions in your career. It’s a good time to start looking at your budget. You may also have student loans to think about. We can provide personalized insurance recommendations to protect you if your ability to earn an income is interrupted at any point in your career. Starting early will help you avoid common mistakes that could hurt your long-term financial freedom.

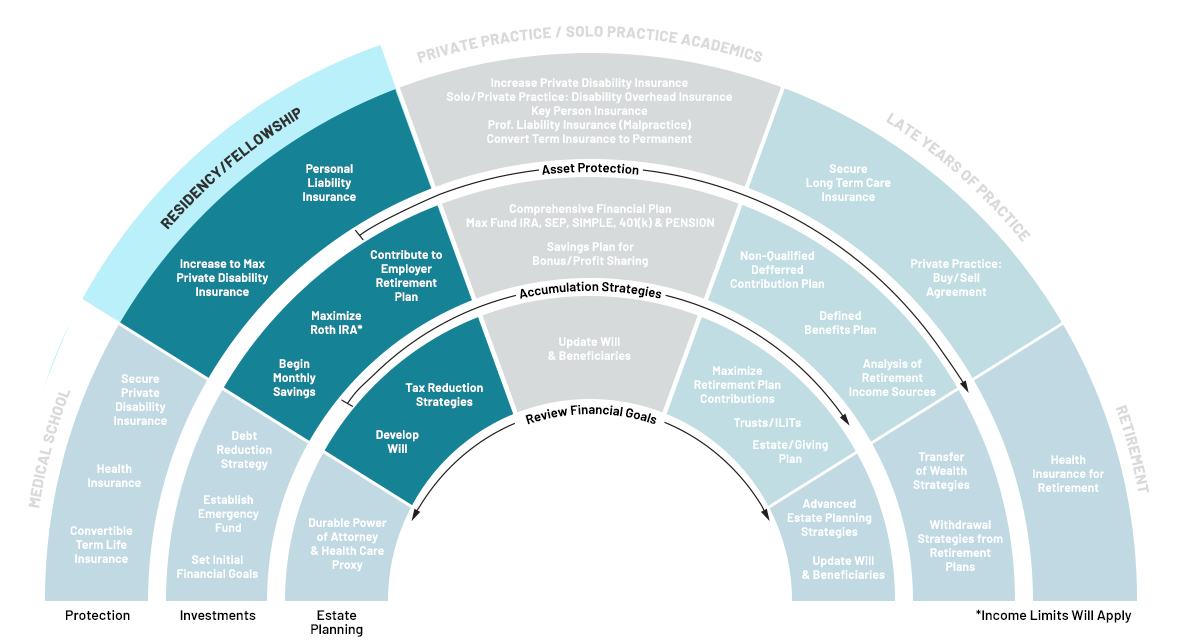

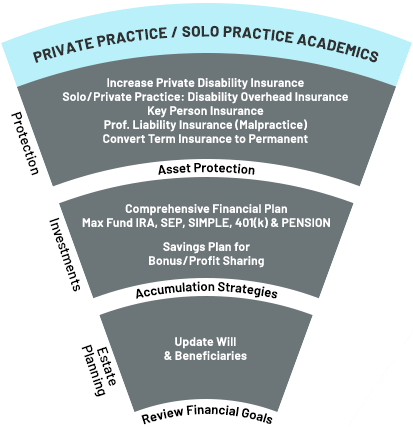

Practicing Physician

Moving from residency/fellowship to practicing physician is a massive shift and a necessary time to have someone helping you navigate the next stages of financial planning. At this stage, layering asset protection strategies will become crucial in planning. As your income increases, we will help you create an investment and retirement strategy that enables you to minimize taxes and take advantage of the powerful tool of compound interest.

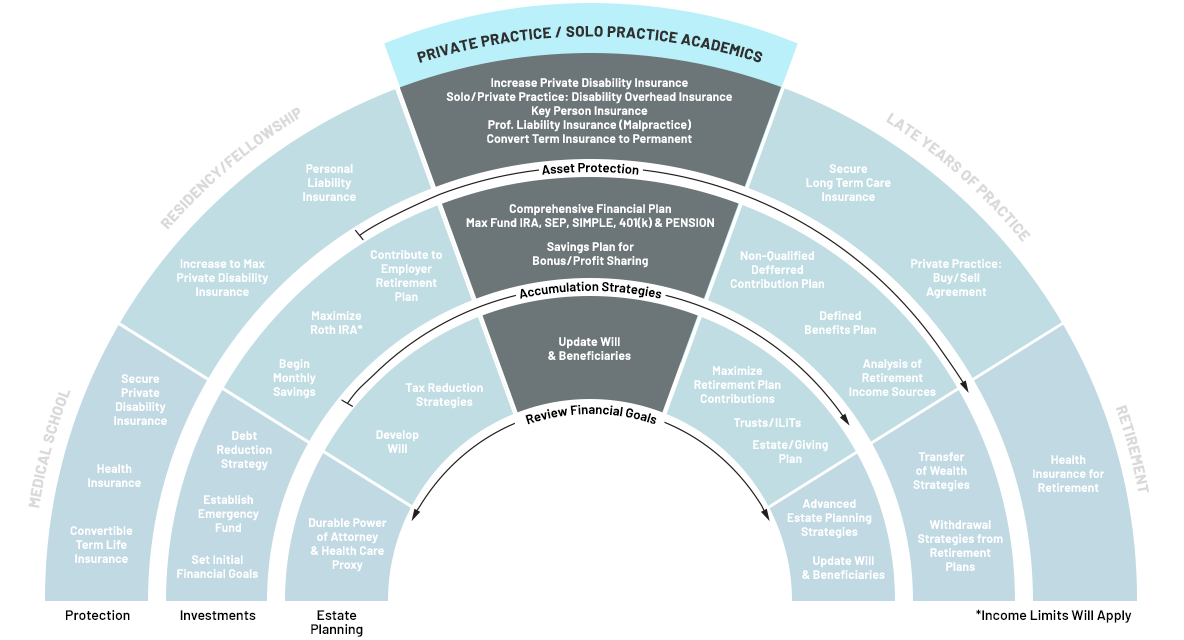

Business Owner as a Medical Professional

Establishing and maintaining a medical practice requires the balance of both personal and business goals, plus meeting the needs of your employees.

We offer comprehensive guidance to help you set your business up for success through anything life may bring. We will help you look at strategies for employee benefits, business insurance lines, Qualified Retirement Plans and customized solutions based on your specific requirements. We will also help solve potential tax*, legal and insurance issues with your current providers or refer you to our credible professionals we work with.

*Specific tax consequences should be verified by your tax advisor. Financial Advisors do not provide specific tax/ legal advice and this information should not be considered as such. You should always consult your tax/ legal advisor regarding your own specific tax/ legal situation.

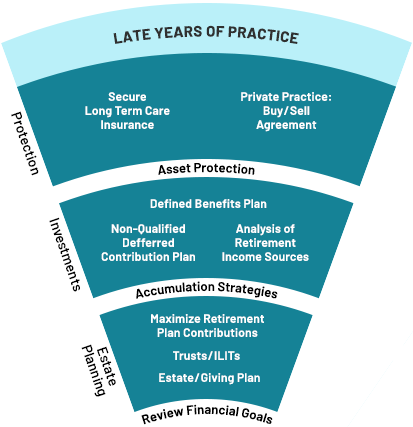

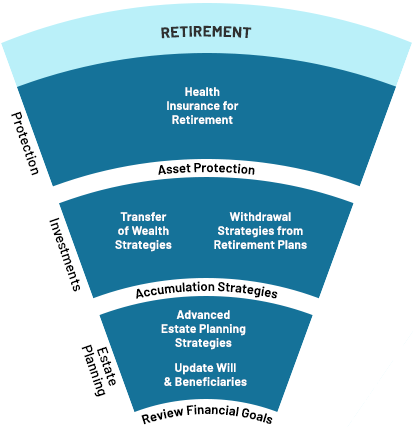

Are you looking forward to Retirement?

You’re almost there. We help you manage life’s complexities with a full spectrum of retirement strategies to create the right type of retirement plan best suited for you and your employees.

Advanced Practice Provider

Advanced practice providers are an integral part of today’s health care system. We will help you build wealth and prepare for the future without sacrificing your valuable time and plan for your financial freedom.

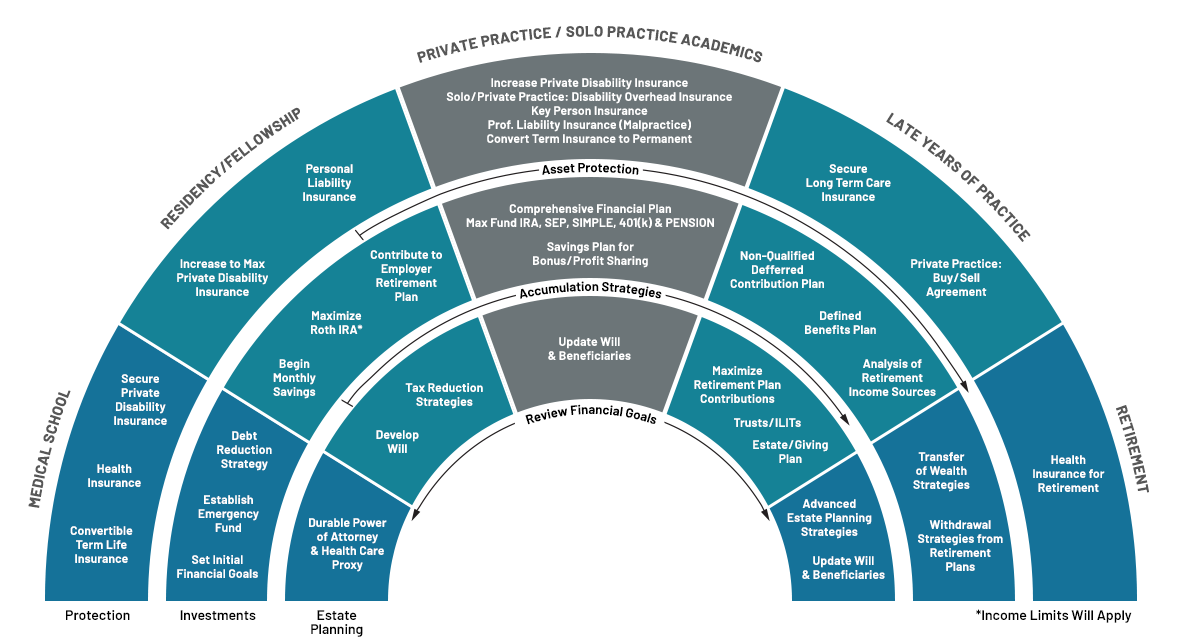

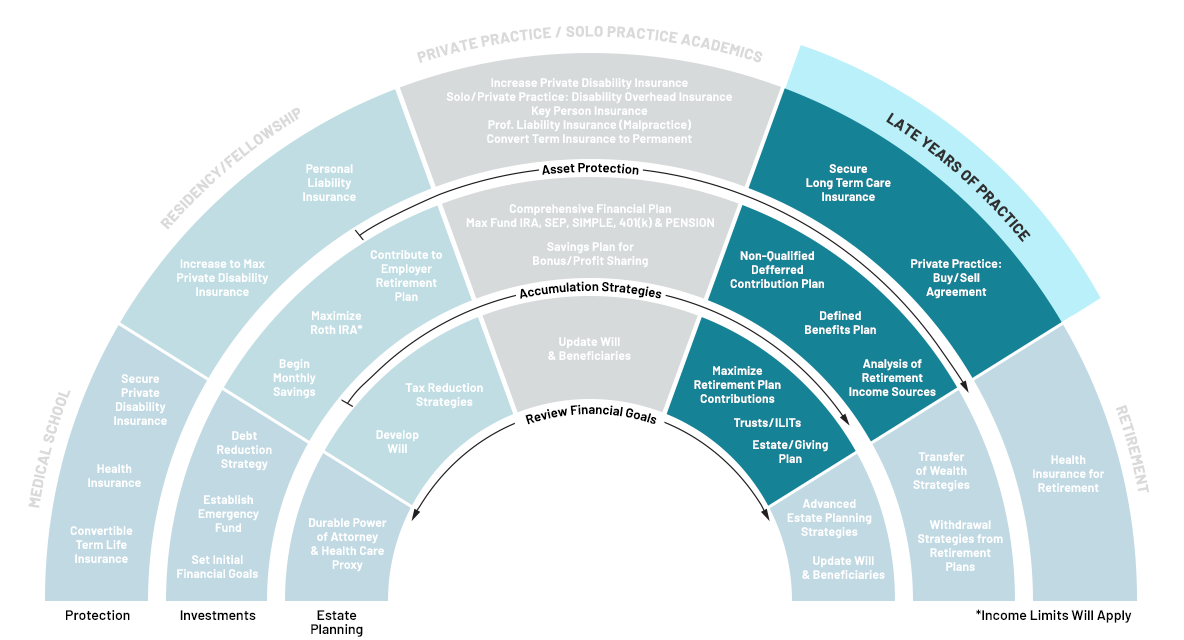

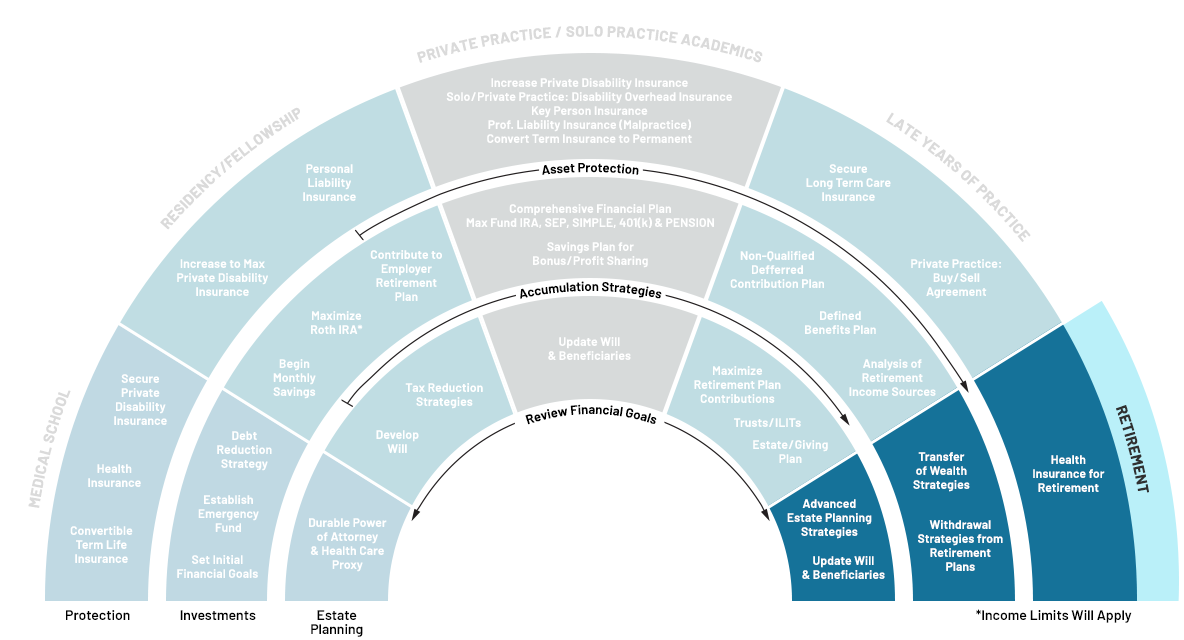

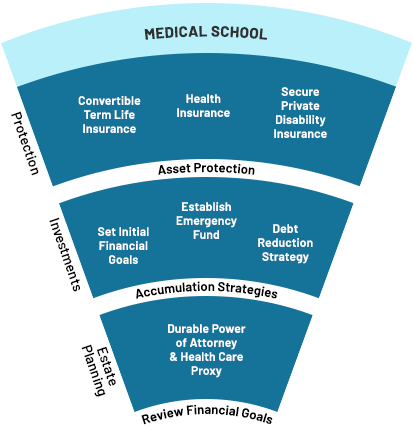

Physician Financial Life Cycle

These are considerations for physicians during their career life cycle. This is not a recommendation to purchase products and/or services. Please speak to a financial advisor regarding your personal situation.

This information should not be considered as tax or legal advice. You should consult your tax and/or legal advisor regarding your own situation.

Securities offered through Cetera Advisor Networks LLC, member FINRA/SIPC. Advisory Services offered

through Cetera Investment Advisers LLC, a registered investment adviser. Cetera is under separate

ownership from any other named entity.

We know that medical professionals require a unique set of financial planning tools. Request an obligation-free consultation to see how we can help.

Advisor Contacts

-

-

James Baker, Jr., CFP®, ChFC®

Senior Associate | Wealth Manager

-

-

Chris Burgos, CFP®, ChFC®, CFS, AIF®

President & CEO | Wealth Manager

-

-

Tyler Malek, ChFC®

Associate Partner | Wealth Manager

-

-

Jeffrey Marsico, CFP®, ChFC®, RICP®, CLU®, CLTC®, MSF

Senior Partner | Wealth Manager

-

-

Ketul Mody CFP®, RICP®

Senior Partner | Wealth Manager

-

-

Bryan Radcliff, CFP®, ChFC®, RICP®

Associate Partner | Wealth Manager

-

-

Hardik Shah, CFP®, ChFC®, CPFA

Senior Partner | Wealth Manager

-

-

Jacob Yates, CFP®

Associate Partner | Wealth Manager